how to open tax file malaysia

Before you try any other ways to open TAX files start by double-clicking the file icon. Submit the form along with a copy of your identification MyKad or other IDs and your salary details EAEC Of course you can also register using the tax offices online portal e-Daftar.

3 12 16 Corporate Income Tax Returns Internal Revenue Service

Where a company commenced operations.

. Choose the Right Program. Companies limited liability partnerships trust bodies and cooperative societies which are. Malaysia Personal Income Tax Guide 2020 Ya 2019.

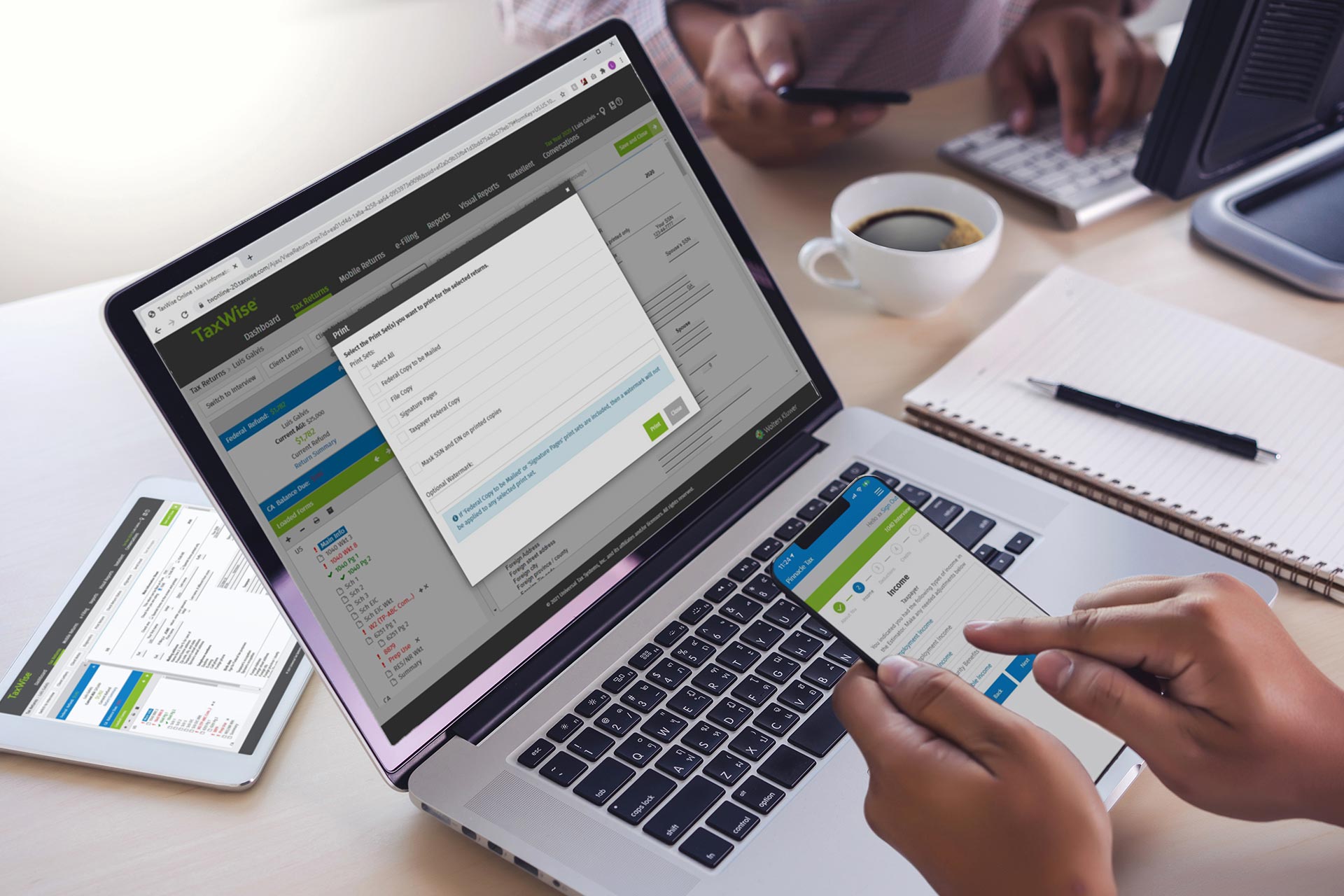

Select Open Tax Return from the File menu Windows or TurboTax menu Mac browse to the location of your. If youre filing your taxes for the first time youll need to register at the nearest LHDN branch or you can use the e-Daftar portal. The file should open automatically.

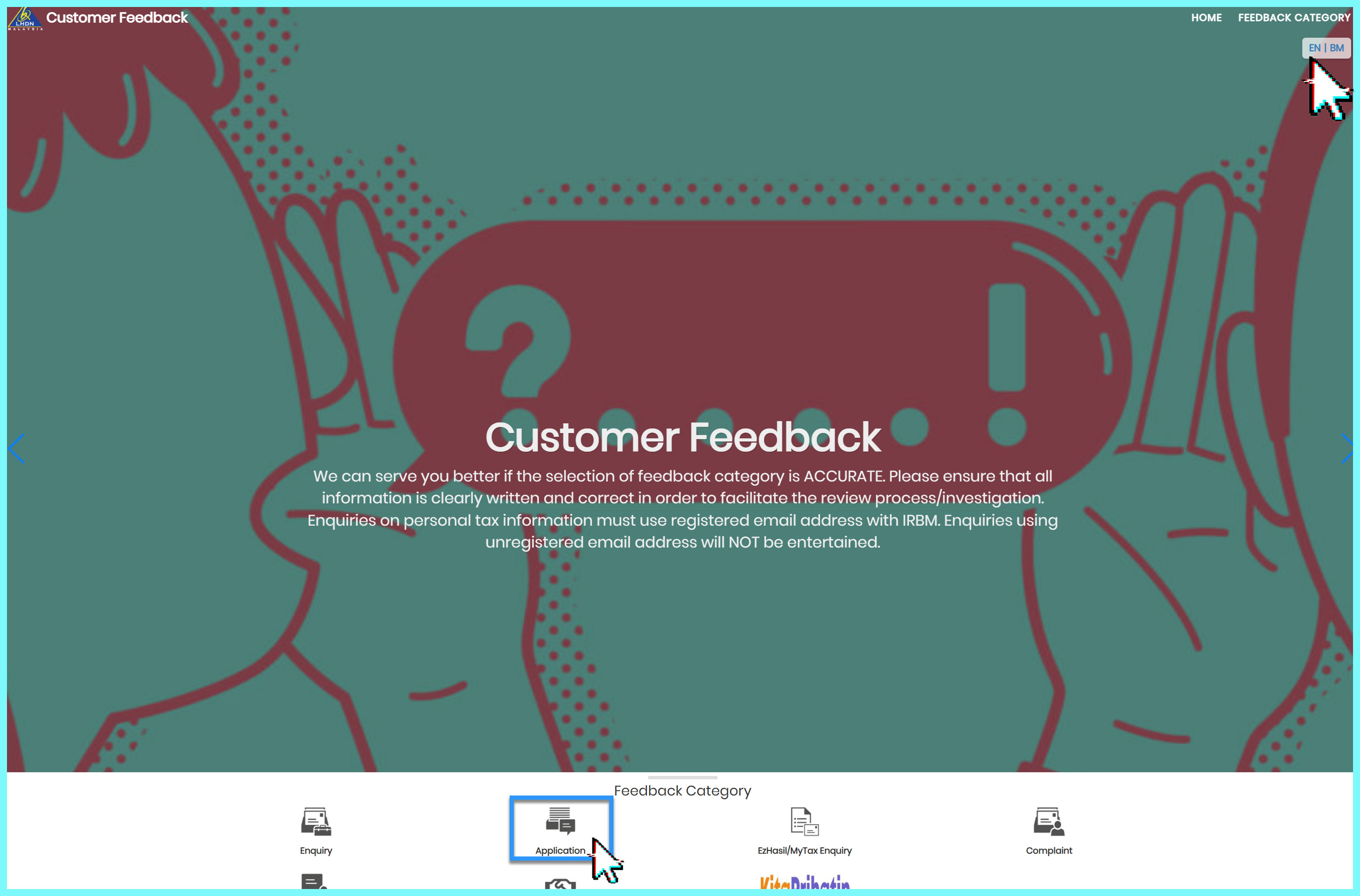

If you have never filed your taxes before on e-Filing income tax malaysia 2019 go to httpedaftarhasilgovmy where you can apply online for the registration of income Tax File. Register Online Through e-Daftar. Visit the official Inland Revenue Board of Malaysia.

This can be done. How do I open LHDN. Youll need to submit two copies of the.

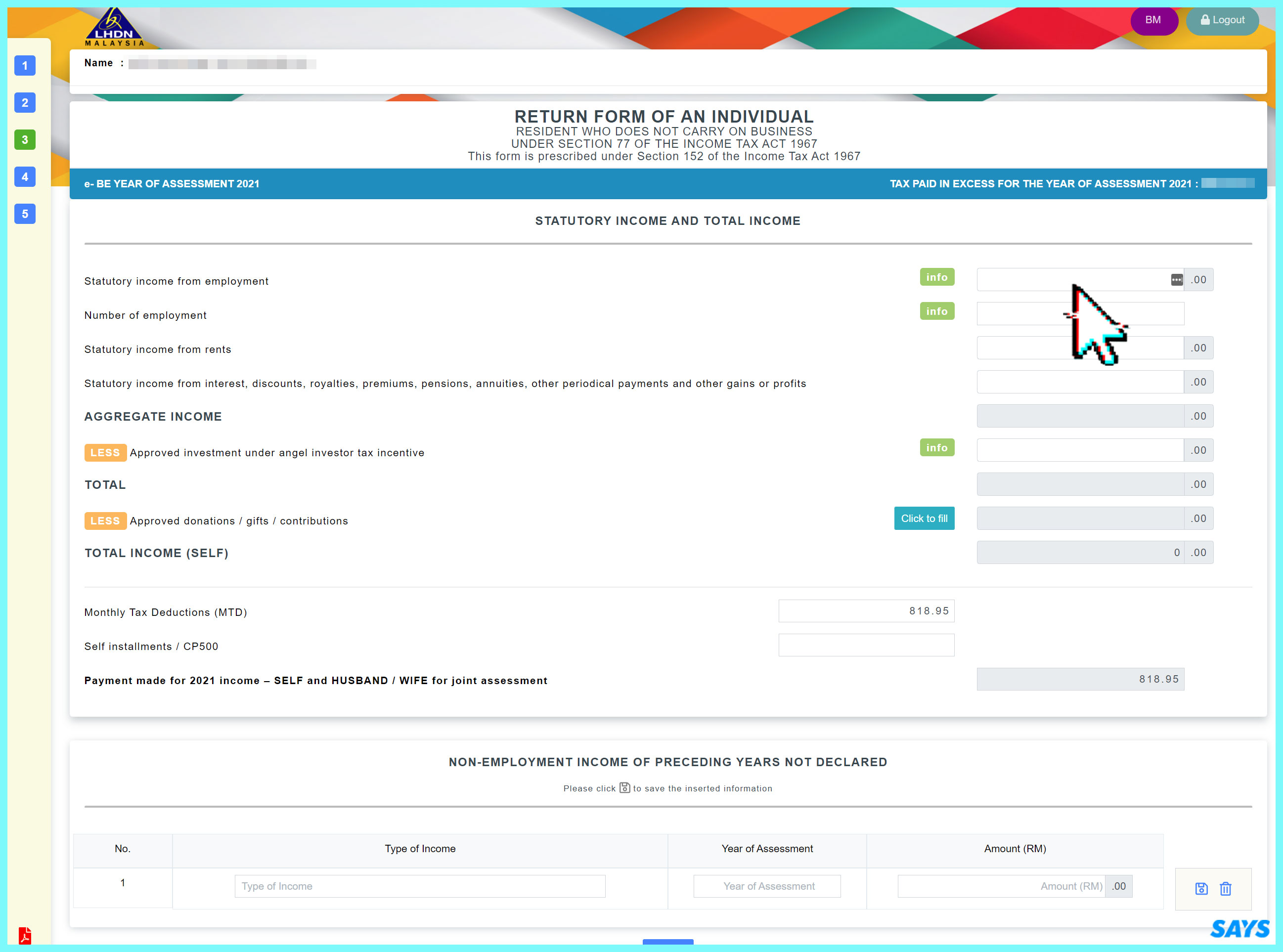

Obtaining an Income Tax Number. The first part is about the preparation and things you SHOULD know before filing your tax retu. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500.

At the IRB office ask for the form to register a tax file. 1 Self Assessment System SAS is based on the concept of Pay Self Assess and File. If you do not hold but require an Income Tax Number you should.

This is a 2 part series on HOW TO FILE INCOME TAX in Malaysia. Fill in your income details. Fill up PIN Number and MyKad Number click Submit button.

In-person registration is available at any Inland Revenue. Tax or tax data file not the PDF select it and then select. Thats a difference of RM1055 in taxes.

You must be wondering how to start filing income tax for the. 1 Begin by registering with the site. To kickstart the process of registering as a.

How do I file my income tax in Malaysia 2020. Login to e-Filing and complete first-time login. Click Online Registration Form Borang Pendaftaran Online fill in your details and log in to.

Once you have the PIN head on to the e-Filing website and click on First Time Login. After EPF deductions are required to file a tax return with the government. The deadline for filing income tax in malaysia also varies according to what type of form you are filing.

Go to httpedaftarhasilgovmy to apply for your Income Tax Reference Number. The tax year in Malaysia runs from January 1 to December 31 and is in sync with the calendar year. To register as a taxpayer you can go to the LHDN office with a copy of your MyKad or equivalent a copy of your latest salary slip or EA form andif applicablea copy of your.

Tax or tax data file not the PDF select it and then select. Fill up this form with your employment details. Browse to ezHASiL e-Filing website and click First Time Login.

In Malaysia income tax is mandated by law and the amount of income tax you owe varies depending on your total taxable income for the year in question. How to Register a tax file in Malaysia. The deadline for filing and submitting tax returns is April 30 of the following.

This enables you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585. Monthly Tax Deduction MTD as Final Tax has been enforced starting from the Year Assessment of 2014 whereby individuals with employment income and MTD have the option not to furnish. How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time.

Login to e-Filing portal by entering user ID PAN. How to register. Taxpayer can file ITR 1 and ITR 4 online.

They need to apply for registration of a tax file. Enter the relevant data directly online at e-filing portal and submit it. If it doesnt open or you see an error.

How Can I Open Income Tax Account In Malaysia. Therell be a text box to enter your. How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time.

Click on the e-Daftar icon or link.

7 Tips To File Malaysian Income Tax For Beginners

Stripe Tax Automate Tax Collection On Your Stripe Transactions

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Sending Money Overseas Tax Implications Wise Formerly Transferwise

Welcome To The North Dakota Office Of State Tax Commissioner

How To Charge Sales Tax In The Us A Simple Guide For 2022

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Taxwise Tax Preparation Software Wolters Kluwer

Filing Your Taxes For The First Time In Malaysia Read This First Ya 2021 Althr Blog

How To File Income Tax For The First Time

Amended Tax Returns How And When To File Form 1040 X Kiplinger

7 Tips To File Malaysian Income Tax For Beginners

![]()

Partnership Taxation Innovative Technology Case Study Deloitte Us

Guide To Using Lhdn E Filing To File Your Income Tax

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

How To File Your Taxes For The First Time

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base